Overview

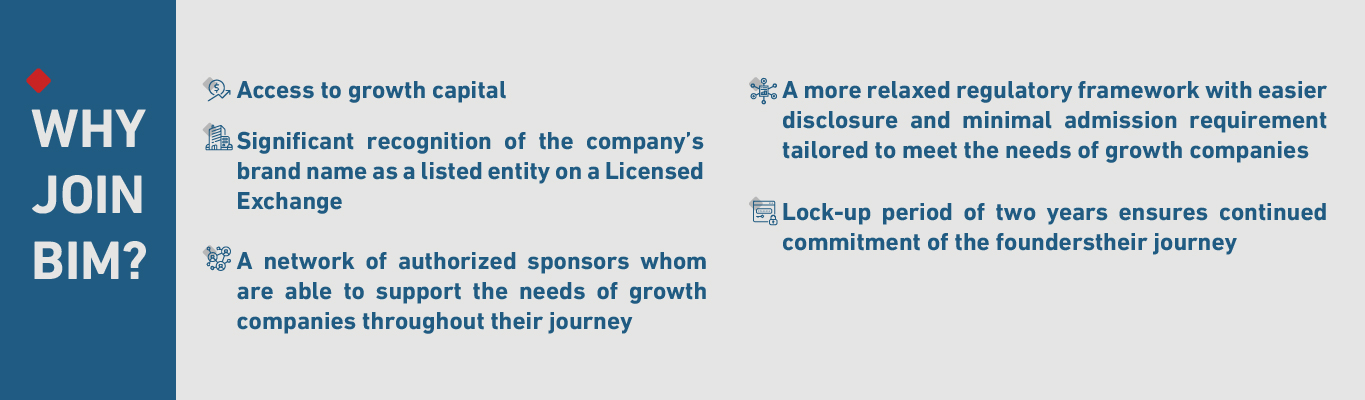

Bahrain Investment Market (BIM) is an innovative equity market that is designed to enable fast-growing companies in the Kingdom of Bahrain, the GCC and wider MENA region to obtain growth capital via direct offering. It offers a more relaxed regulatory framework with easier disclosure and minimal admission requirements, as well as enables companies to transition from the BIM to the Regular Market.

Investing and trading in Bahrain Investment Market (BIM) companies is open to investors and traders from all nationalities without any restrictions. BIM rules are approved by the Central Bank of Bahrain and the market is operated by Bahrain Bourse.

The Bahrain Investment Market (BIM) enables fast-growing companies to obtain the needed growth capital for expansion and also has the ripple effect of encouraging entrepreneurship, creating new job opportunities, and boosting the private sector's contribution to the national economy. BIM aims to attract listing of growth companies in a number of key target sectors.

Listing Requirements - Eligibility Criteria

- Minimum paid-up capital required for Admission is BHD 50,000 or its equivalent in other currencies;

- Applicant must be established or converted to a Closed Shareholding Company in the Kingdom of Bahrain or its equivalent in any other jurisdiction;

- Sufficient working capital upon submission of the listing application;

- Maintain a Free Float of at least 10% of the total issued outstanding shares;

- Minimum shareholders are 2;

- Two year lock-up period starting from the date of listing on Founders;

- Attain best practices in corporate governance

Authorized Sponsors

Fees

Registration Fees

|

Annual Registration Fees

|

Sponsor Fees

|

BD 1,650

|

0.3% of the Company’s Paid Up Capital plus VAT (minimum BD 1,100 and maximum of BD 5,500)

|

BD 2,200/annum |